tyba

Democratizing investments

Digital Financial Services| Design Leadership | User Research | UX Design | Product Design

2019 - 2022

4 Products

launched and scaled

14-Member

design team built & led

3 Countries

reached in Latam

Context & Challenge

Credicorp Capital traditionally targeted clients with over 750,000 USD to invest, offering them personal financial advisors. This left a large segment of people with lower investment capacity—eager to start investing—completely unattended. The challenge was to create a scalable solution that could replicate the guidance of an advisor through technology, while addressing the unique needs and behaviors of this new audience.

Main Objective

Develop a digital investment platform that enables access to financial products, providing simple, trustworthy guidance for first-time and small-scale investors.

My Role & Responsibilities

• Built and scaled the design function from scratch, establishing processes, tools, and standards.

• Led the design team, conducting competitor analysis and guiding research, strategy, and product design.

• Translated research insights into product features, ensuring usability and accessibility.

• Guided product scalability across countries, considering local markets.

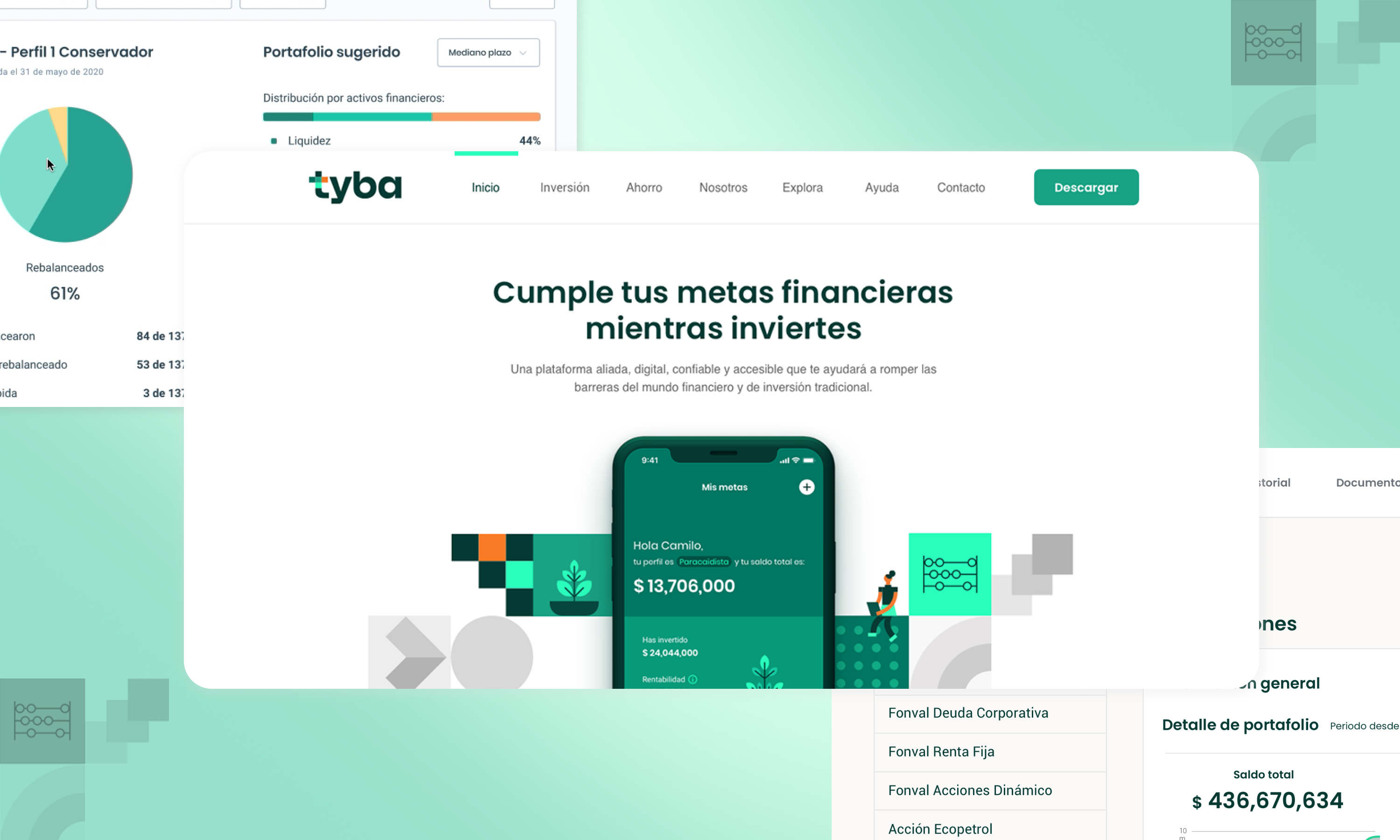

Image 1: Our design process

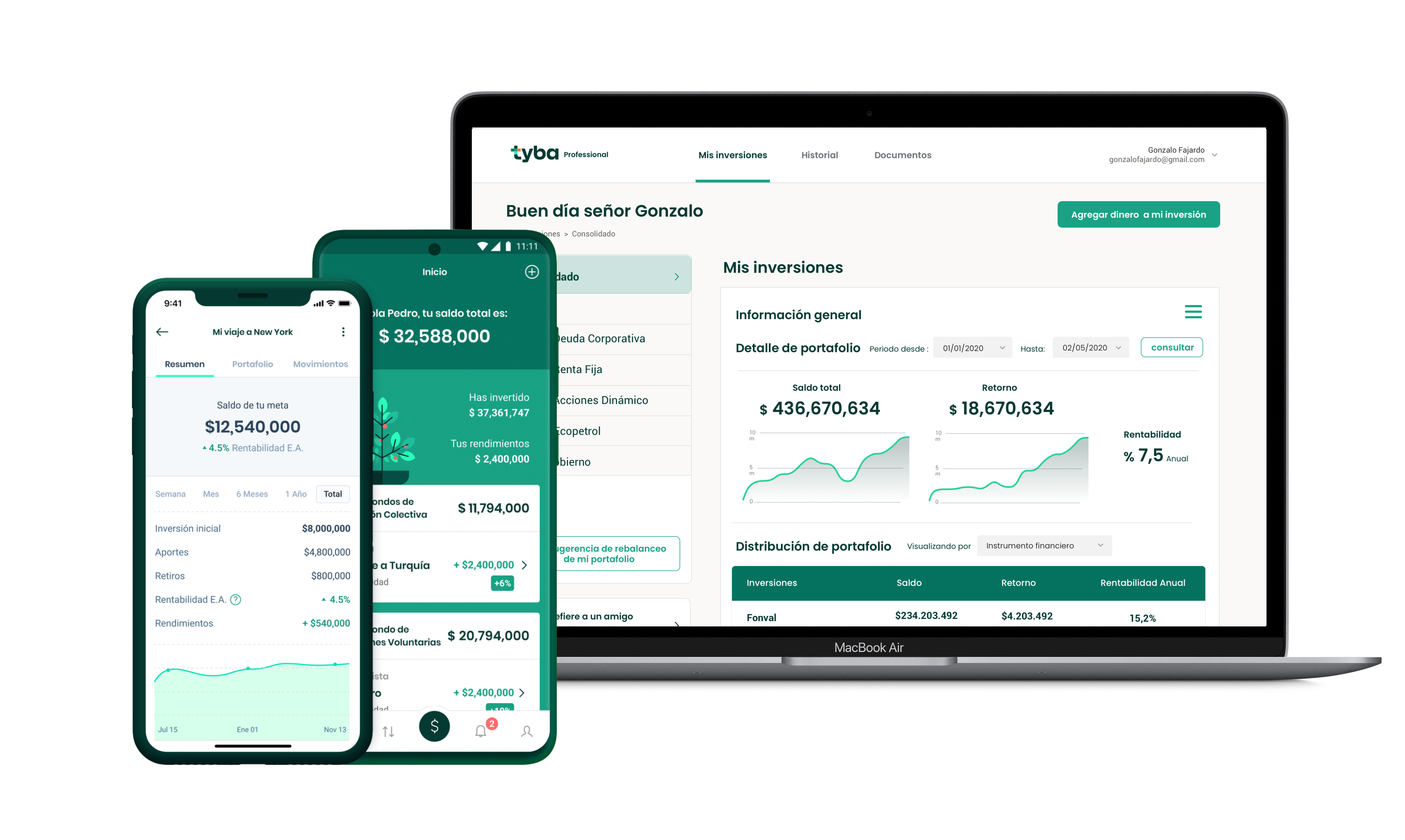

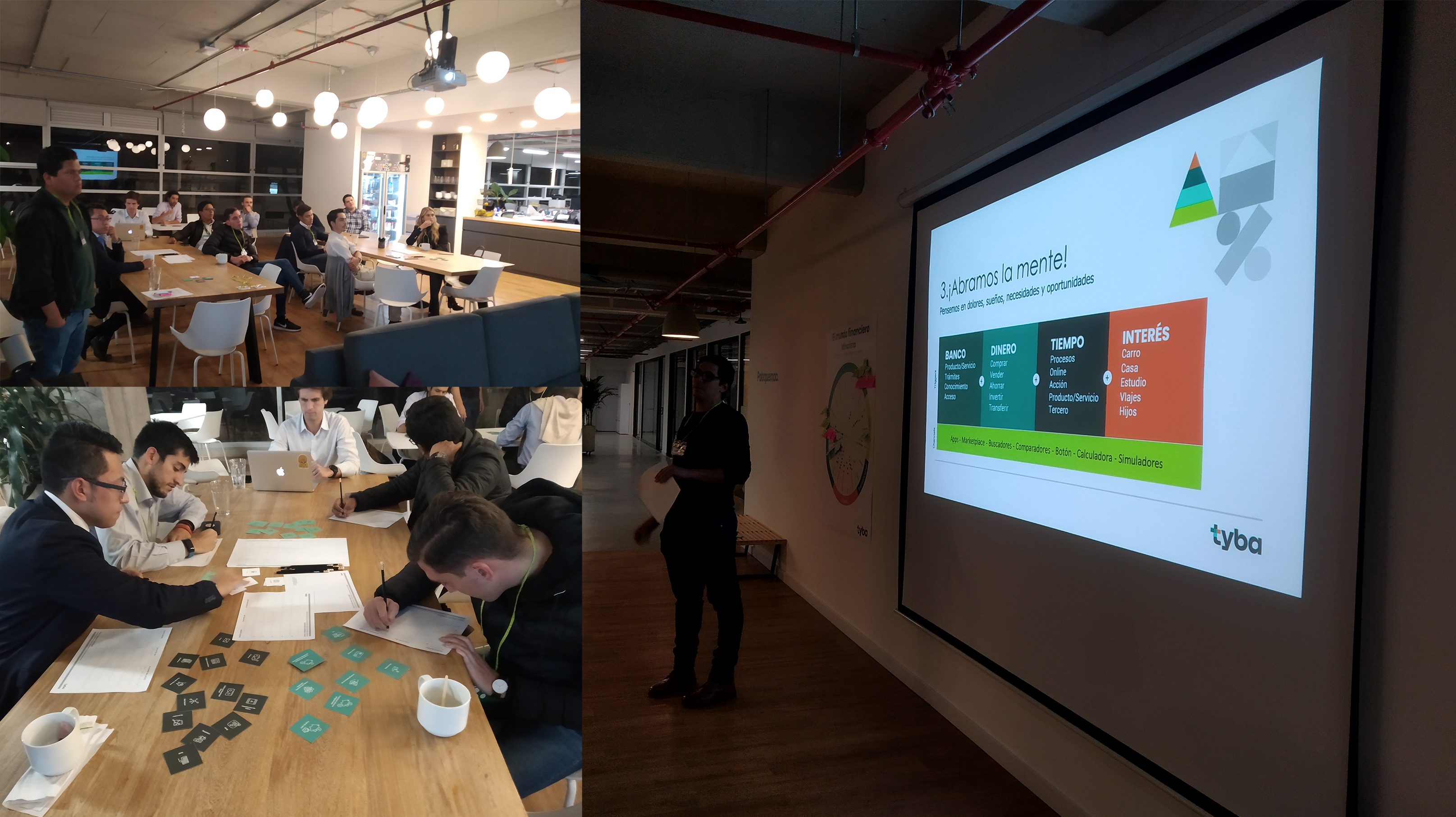

Image 2: Co-creation workshop: Exploring User Motivations

Image 3: Co-creation workshop: Feed me for Feeback

Approach & Key Actions

• Conducted qualitative and quantitative research to uncover user archetypes and investment behaviors.

• Identified key insights, including a lack of financial education, the importance of both short- and long-term goals, and home ownership as a primary aspiration.

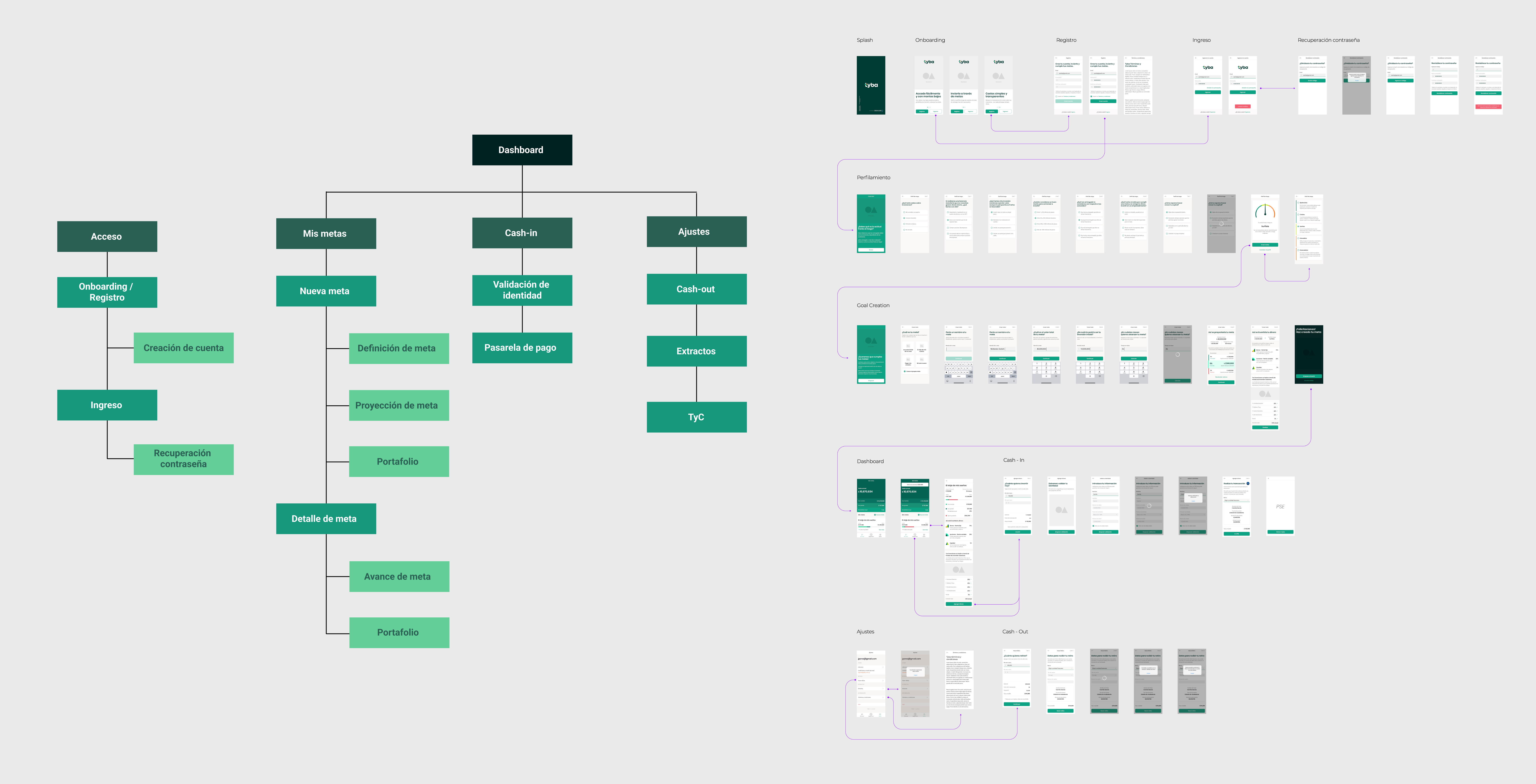

• Tested and iterated on concepts and low- to high-fidelity prototypes before handoff to development.

• Led the design of both the investor-facing mobile and web platform and a portfolio management web app, simplifying investment decisions while enhancing high-net-worth client management.

• Mapped the conversion funnel, identified behavioral friction points, and supported the event-tracking framework to measure engagement and drive continuous product improvement.

Image 4: MVP's Information Architecture and Userflow

Video 1: Validating Voluntary Pension fund product

Lessons learned

A plant-growth metaphor was initially used to visualize investment growth. We later learned that it failed to account for real-life financial behaviors such as emergencies or withdrawals. This highlighted the need to challenge appealing concepts early and validate them against complex, real-world scenarios.

Impact & Results

• 33k users and 2000 customers in just 3 months of operation.

• Launched 4 digital investment products that expanded access to financial services.

• Increased financial confidence among first-time investors through education and guidance.

• Provided scalable advisor-like support through technology.

• Strengthened Credicorp Capital’s positioning as an inclusive financial services provider.